Social Security represents an important source of income for millions of Americans who paid into the system during their working years. Despite contributing thousands of dollars to the program on average, many people have concerns about the future of the Social Security Administration. Estimates from the SSA itself suggest the trust funds used for benefits payments could be depleted as early as 2033 unless changes are made to the program’s funding structure.

Key Takeaways

- Social Security is a program that uses taxes to fund a benefits program for individuals who contributed to the program during their working years.

- Two trust funds hold the funds raised through these taxes, but they are estimated to be depleted by around 2033.

- The government has acted decisively in the past to make the necessary changes to keep Social Security afloat.

- Social Security should be just one part of your overall retirement plan, alongside investments, savings and lifestyle changes.

How Does Social Security Work?

Social Security is a taxpayer-funded program designed to supplement income for retired individuals and certain other groups. A great number of American workers—184 million people, according to the Social Security Administration—pay taxes into the Social Security system which funds benefits for current Social Security recipients. When those workers retire or otherwise qualify for Social Security themselves, they will receive benefits equal to a percentage of the amount they contributed in taxes.

While many people think of Social Security as a benefit entirely for retired individuals, that’s not the only group receiving regular benefits from the SSA. Other recipients of Social Security benefits include:

- People with qualifying disabilities

- Spouses and children of workers who died

- Dependent parents of workers who died

- Spouses and children of Social Security recipients

Is Social Security Running out of Money?

To understand the current state of Social Security, it’s essential first to comprehend how your Social Security taxes are allocated to current beneficiaries.

The tax money collected for Social Security is distributed into one of two trust funds—the Old-Age and Survivors Insurance (OASI) trust fund and the Disability Insurance (DI) trust fund. The funds are then used to pay benefits to their corresponding recipients, with any leftover money invested by the government.

According to estimates released by the SSA, these trust funds are shrinking and could reasonably be expected to be depleted entirely within approximately 15 years. If these trust funds are depleted, the annual income from taxes would only be sufficient to cover 79 percent of the total benefits needed.

If nothing is done to prevent this from happening, Social Security beneficiaries may see a decrease in the percentage of their contributions returned as benefits drop. Benefits would be lower, but they would not disappear entirely.

It’s also important to note that the trust funds have come close to depletion in the past, but the government has successfully intervened to prevent it. In 1982, Congress was forced to enact emergency legislation to prevent the collapse of the OASI fund. The crisis was averted, and better funding mechanisms were created for the fund to reduce the likelihood of a future crash.

While it is still unclear if or how the federal government might intervene on Social Security’s behalf, even in the worst-case scenario, recipients would still receive a return of some percentage of their investment into the program.

How to Financially Plan Around Social Security?

Regardless of whether or not the Social Security trust fund remains financially solvent, it’s important to have a healthy investment portfolio to prepare you for retirement. Many financial planners recommend aiming for 80 percent of your pre-retirement income from a combination of investments, savings, and Social Security benefits. For the average earner, Social Security benefits are typically between 40 and 50 percent of pre-retirement income.

Many types of investments can help you navigate your retirement more comfortably.

Set up a retirement fund

A retirement fund is a long-term investment account designed to provide certain tax benefits if the money is left untouched for a specified period. They can be created by people of any age, and are a very common tool for those wishing to invest in their retirement.

Max out 401K employer Contributions

Many companies offer matching funds for employee contributions to a 401K retirement account. These accounts function in a similar way to retirement funds, but employers will match employees’ investments up to a certain amount from each paycheck. These matching funds are paid in addition to your paycheck, and it’s a good idea to invest at least enough to reach your employer’s maximum contribution.

Open an IRA

An individual retirement account, or IRA, is another type of account set up to maximize tax benefits for long-term investments. Taxes aren’t paid on funds invested in an IRA at the time they’re placed in the account, making them an appealing target for investment.

Leverage Health Savings Accounts (HSAs)

Medical expenses can be significant at any age, and as you near retirement age, you might find yourself needing to increase your spending on healthcare. An HSA allows for tax-free contributions and growth while the funds are in your account, and those funds can be spent tax-free if they are used for qualifying healthcare products and services.

Lower Housing and Living Expenses, If Possible

Many people find themselves downsizing from much larger homes as they near retirement age. As children grow up and move out, a smaller, lower-upkeep residence becomes appealing to many people. Reducing your footprint, and thereby your costs, is a great way to supplement your savings and investments as you enter retirement. Lower overhead means the percentage of pre-retirement income necessary to sustain your lifestyle stays low as well.

Bottom Line

While there do appear to be some changes on the horizon for Social Security, there’s no need to panic about an unexpected loss of benefits for future recipients. Even without government action, the program will still be able to operate at around 80 percent capacity. With appropriate government intervention, the program can remain totally solvent and continue supporting retired workers, disabled individuals and many other people and families for years to come.

No matter what happens to the SSA, it’s smart to maintain a balanced set of investments as you plan your retirement. Social Security is a crucial component of the retirement puzzle for many individuals, but it should never be viewed as the sole source of income for retirees.

Horizons Wealth Management can help you with your financial future, even if Social Security is a bit tumultuous. Schedule a call today and start planning for your retirement.

Social Security FAQ

H3: What happens if Social Security runs out of money?

If the Social Security trust funds run out of money, benefits will likely be reduced to match the level of funds coming into the program from taxes. The SSA estimates it could operate Social Security at around 80 percent capacity if this were to happen.

At what age do you get 100% of your Social Security?

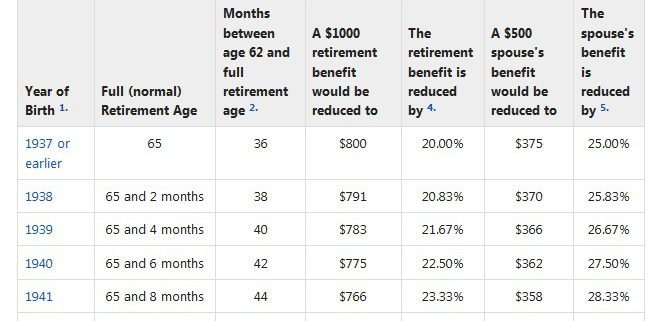

You will receive the full amount of your Social Security benefits if you begin drawing them after you reach the full retirement age. This age has increased slightly over time, but is currently 67 years old.

Do RMDs Affect Social Security?

Required minimum distributions don’t directly impact your Social Security benefits, but they can affect your tax liability. The amount of taxes you must pay on your benefits is determined by your income bracket, and RMDs are treated as income for tax purposes. If your RMD increases your tax bracket, you might have to pay more taxes on your SSA benefits.

How do I know if I’m ready to retire?

Retirement looks different for everyone, and the age at which you’re able to stop working is largely dependent on your pre-retirement income, your overhead, savings and investments. Many planners recommend creating a strategy to access around 80 percent of your pre-retirement income, but this number can be much lower or higher for certain individuals.